Health Impact News

October 10, 2014Who are the Children of Abraham?

The answer to the question, “Who are the children of Abraham?”, is one that has been largely misunderstood and corrupted by religious dogma for thousands of years now.

And with world events dramatically changing right before our eyes on a daily basis, it is imperative that you understand just who are the “children of Abraham,” because it is a matter of life and death, with eternal consequences.

In a world filled with lies, disinformation, and fake news, this truth of who the true descendants of Abraham are, is truly GOOD NEWS for a world that desperately needs some good news today!

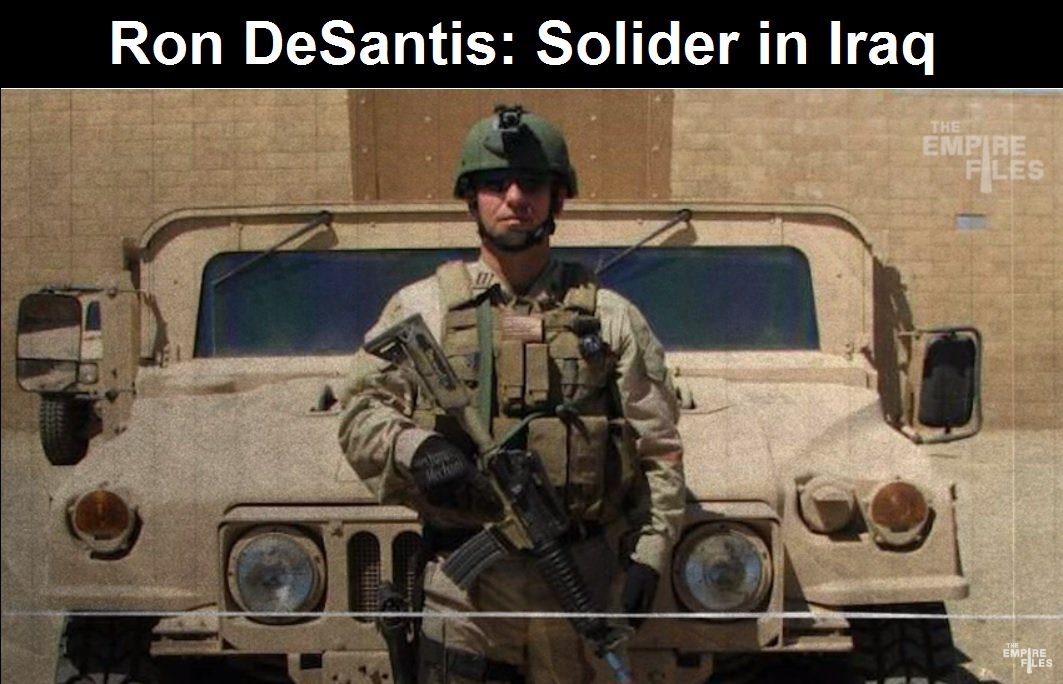

Americans, Beware What Belies the Smile of Ron DeSantis

So many military staffers and guards passed through Guantanamo during my 14-year detention that I remember only the kindest, and the cruellest – the ones who seemed to take joy in our misery.

In 2021, just as my memoir – Don’t Forget Us Here, Lost and Found at Guantanamo – was about to be published, I was on Twitter and saw a photo of a handsome man in a white navy uniform.

It was Ron DeSantis, the governor of Florida. I do not remember what the post was about – probably something about him clashing with President Joe Biden over COVID policies.

But I remembered his face. It was a face I could never forget. I had seen that face for the first time in Guantanamo, in 2006 – one of the camp’s darkest years when the authorities started violently breaking hunger strikes and three of my brothers were found dead in their cages.

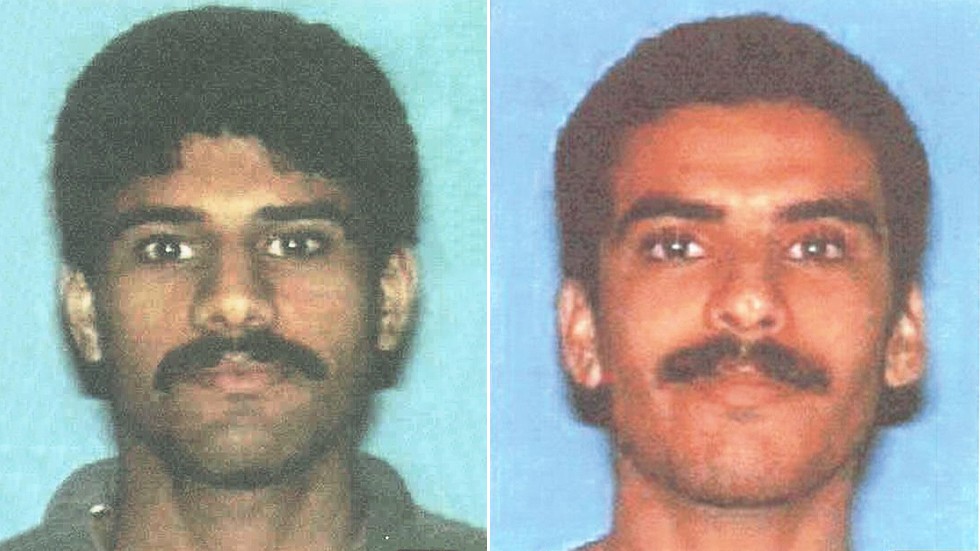

Declassified Guantanamo Court Filing Shows 9/11 Hijackers were Recruited by the CIA

For the past several days, the media, both the corporate media as well as the alternative media, have been widely reporting news about the alleged “Pentagon leaks” which resulted in an arrest today of a suspect who was charged with espionage.

I have not published anything about this story yet, because I really have not seen anything that was allegedly leaked that was important enough to report on, as other news seems more important, and I was not sure if this alleged “leak” was intentional or not, possibly to control the public narrative.

And while I am still unsure about that, another news item that has been happening almost simultaneously and that has not been widely reported, was brought to my attention today, and from my perspective, is probably a much larger news story.

And that news is that a copy of a previously heavily redacted document filed with the Guantanamo Military Commission was obtained by Seth Hettena of SpyTalk, unredacted, and that this now unredacted court document shows that two 9/11 Saudi hijackers were recruited by the CIA, and then afterwards the CIA tried to keep this information secret from the FBI.

It's Time to Stop Supporting Zionist Israel

The recent massive protests in Israel against the Zionist Netanyahu government clearly show there are many Israelis today who do not support their government.

Why then are Evangelical Christians in the U.S. almost universally supportive of Israel’s Zionist criminals?

With the geopolitical landscape in the Middle East radically changing these days, it is time for America to stop supporting Zionist Israel, and to start focusing on developing our own economy and ending the funding of Israel and these endless wars in the Middle East.

The CIA and their sister organization in Israel, Mossad, have dominated western media with their propaganda that Israel’s military is simply defending Israel from Muslim terrorist groups who want to destroy Israel.

What is almost never reported in the western corporate media is that Israel’s attacks on Palestinians, Syrians, Lebanese, etc., are not simply just attacks on Muslim terrorists, as there are significant Christian populations as well in all of these locations who are also suffering from Israel’s actions.

We are featuring two articles on this topic today to hopefully educate people on the truth regarding modern-day Israel and their Christian Zionist roots, especially their infiltration into U.S. Evangelical Christianity.

The first one is an article published today by Chuck Baldwin of Liberty Fellowship. Baldwin mentions the two founders of Evangelical Christianity’s Zionist movement, while the second article, by James Perloff, goes into much more detail regarding the history of Evangelical Christian Zionism.

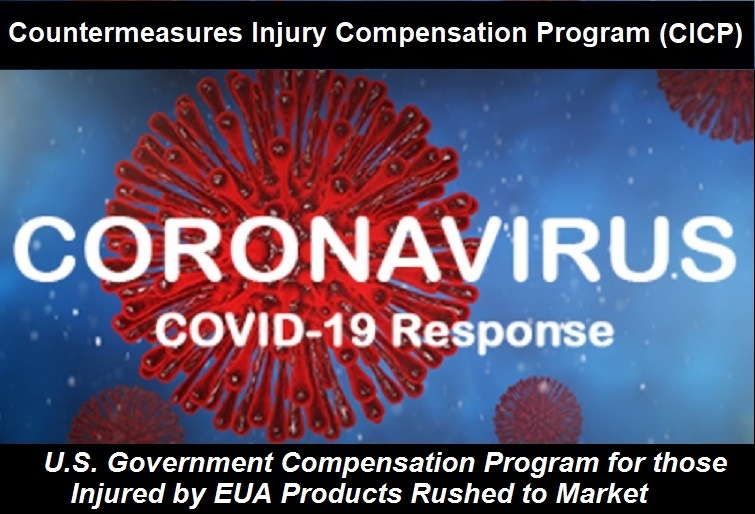

OUTRAGE! U.S. Government Finally Compensates First Petitioners for COVID-19 Vaccine Injuries: 3 People Awarded an Average of $1,500 for Damaged Hearts

After 674,375,206 doses of COVID-19 “vaccines” injected into 270,045,602 Americans over the past 2+ years, and over 11,000 petitions from COVID-19 “vaccine” injured people filed with the U.S. Government’s CounterMeasures Injury Compensation Program, the U.S. Government just announced the first settlements for COVID-19 “vaccine” injuries: 3 people, 2 of whom now have damaged hearts (myocarditis), were awarded a total of $4,634.89, an average of about $1,500.00 per person.

Yes, you read that correctly. An average of one thousand five hundred dollars per person, as another 11,000+ people wait for their settlements.

In February of 2021, the Biden Administration gave $4 BILLION to Bill Gates and the World Health Organization (WHO) for a new global COVID-19 vaccine injury compensation program designated for 92 low and middle-income countries in an effort to entice poorer countries who were skeptical of the new COVID vaccines.

So to date, the U.S. Government has spent $4 BILLION to compensate COVID-19 vaccine injuries through Bill Gates and the WHO in poorer countries, but only $4,634.89 for Americans injured by the COVID-19 shots.

OUTRAGEOUS!!!!

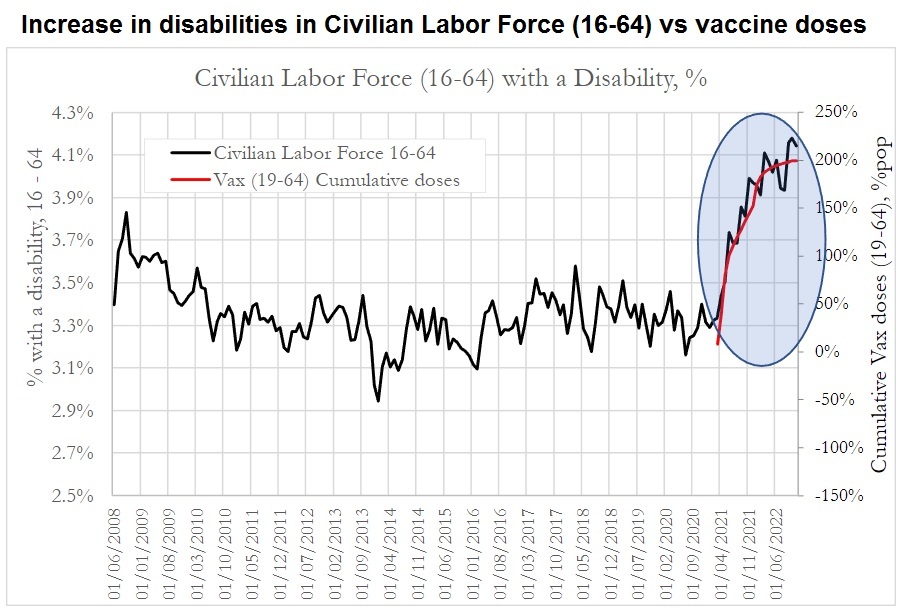

U.S. Chamber of Commerce: 3 Million Fewer Americans are Working Today Compared to February 2020

The U.S. Chamber of Commerce published statistics last week that show there are 3 million fewer Americans working today than there were in February of 2020, before the “pandemic.”

They reported that the latest data shows that we have over 10 million job openings in the U.S.—but only 5.7 million unemployed workers.

They also reported that the labor force participation rate is 62.6% today, down from 63.3% in February 2020. That means there are 1.8 million missing workers today.

What happened to all these missing workers?

The Chamber of Commerce admits that “there’s not just one reason that workers are sitting out, but several factors have come together to cause the ongoing shortage.”

However, one of those reasons they did not consider or report about, were deaths and disabilities due to the Operation Warp Speed mass vaccination program of COVID-19 shots that began at the end of 2020, and were widely mandated as a condition for employment throughout 2021.

Edward Dowd and his Phinance Technologies has supplied that data for us, which I reported on last week. Dowd’s data shows that deaths and disabilities skyrocketed as the experimental COVID shots were injected into Americans.

The U.S. Chamber of Commerce surveyed unemployed Americans in 2021 and 2022 to find out why they had not returned to the workforce. Only one third of those surveyed stated that they wanted to return to work full time, and almost half of those surveyed stated that they would not return to work unless they could work from home.

Why?

According to their survey, the top two reasons given were they were too ill to return to work, or that they needed to stay home to take care of children or others in their family.

Rothschilds Send French President Macron to China in Attempt to Save Europe as U.S. Rockefeller Empire Panics

French President Emmanuel Macron’s recent trip to China has sent shock-waves throughout the Western World, especially after he stated that Europe needs to stop being “America’s followers” and not get involved in China’s conflict with Taiwan.

The U.S. corporate media’s initial report about why Macron was visiting China was that he was allegedly asking China for help in the Ukraine conflict against Russia, and assurances that China would not supply arms to Russia.

But during the rest of Macron’s visit, which included signing a new agreement between the two countries which has received very little attention in the Western media, and Macron’s subsequent visit to the Netherlands where he delivered a speech at the Hague earlier today, outlining a new plan for Europe, we can now clearly see what was the true purpose of this trip to China.

It would appear many in Europe, and especially the Rothschild family banking empire, are waking up to the fact that the U.S. is no longer a reliable ally and does not have Europe’s best interest in mind in the conflict with Russia and the war in Ukraine.

Europe’s banks are failing, which started with Switzerland’s second largest bank that failed a few weeks ago, and wiped out pensions with bail-ins and has caused non-stop protests in France over pension reforms. This is a direct consequence of the failed policies against Russia over the Ukraine war.

The Rothschild’s banking empire is centered in France and London, and Emmanuel Macron is the Rothschild’s hand-picked man, as he is a former banking executive for the Rothschilds who became the President of France with no prior elected political office.

So what I imagine happened is that someone high up in the Rothschild family contacted someone high up in the Chinese ruling elite and asked for help to fight back against the Rockefeller U.S. empire, and China was only too willing to oblige, as long as France made some concessions, like agreeing to stay out of their conflict with the U.S. and Taiwan.

With really no other choice before them, they called up Macron and told him to pack his bags and sent him off to China. As Macron now heads back to France, he is rallying other European countries to unify against the United States’ global dominance in order to save Europe.

Unlike the U.S., China Issues Warning about Dangerous ChatGPT AI Financial Bubble

As someone who grew up with modern computer technology and at one time earned my living from it, and as someone who not only lived through the dot.com financial collapse but has also owned an ecommerce business for over 21 years and has survived multiple economic downturns, it has been plainly obvious to me that the current financial frenzy over chat AI hype is one of the largest developing financial bubbles being blown up with no real model of generating revenue at this time.

And yet, hardly any other financial analyst has come out to expose this very dangerous financial bubble that could burst at any time, and potentially sink the entire economy, until today.

But that financial analysis over the current spending frenzy regarding AI did not come from any financial analysts in the U.S., but by the Chinese Government.

China is the world’s second largest investor in technology start-ups by venture capitalists, with only the U.S. spending more.

The Chinese government might be regulating the AI industry to prevent a financial crash over this wild speculation in the Tech sector over OpenAI, based on an opinion piece published earlier today in a Chinese financial publication.

Chinese shares related to artificial intelligence plunged after a state media outlet urged authorities to step up supervision of potential speculation.

The ChatGPT concept sector has “signs of a valuation bubble,” with many companies having made little progress in developing the technology, the Economic Daily wrote in a commentary Monday:

“Regulators should strengthen monitoring and crackdown on share-price manipulation and speculation to create “a well-disclosed and well-run market,” according to the newspaper, which runs a website officially recognized by Beijing. Companies, it said, should develop the capabilities they propose, while investors should refrain from speculating.”

Of course, the U.S. is also threatening regulation over the Tech sector, including TikTok, which currently provides $billions to the U.S. economy.

The other huge concerns regarding the feeding frenzy over new AI technology, as I reported in a recent article, is that there are legal issues regarding privacy and copyright issues that could severely curtail using the new OpenAI technology, if not outlaw it altogether.

Traffic Accidents and Deaths Soar in 2021 Following Roll-out of COVID-19 "Vaccines"

The National Highway Traffic Safety Administration (NHTSA) recently released its annual study of crashes on U.S. roads for 2021, and found that “The total number of accidents rose by an astonishing 16%.”

This was “astonishing” because: “That was a year of COVID-19 lockdowns and travel restrictions, when police groups nationwide reported that the smaller number of drivers on America’s roads were acting more recklessly than normal.”

What do analysts say was the cause of this “astonishing” increase in traffic accidents in 2021? They say it was due to too many drivers speeding, driving while drunk, and texting too much.

COVID-19 injections, of course, are never even considered, because that would be politically incorrect to blame the emergency-use authorized experimental shots for an increase in traffic accidents.

However, “Road Traffic Accident” is a “symptom” tracked following vaccines in the U.S. Government’s Vaccine Adverse Events Reporting System (VAERS), so let’s see what was reported for 2021, as compared to the previous 10 years following vaccines before the experimental COVID shots were approved.

In 2021, there were 356 cases filed in VAERS of Road traffic accidents following COVID-19 shots, including 33 deaths, 21 permanent disabilities, 100 ER visits, and 165 hospitalizations.

By contrast, following all FDA-approved vaccines for a 10-year period from 2010 through 2019, before the experimental COVID shots were authorized, there were 70 total cases filed for Road traffic accidents, including 5 deaths, 6 permanent disabilities, 39 trips to the ER, and 19 total hospitalizations during a 10-year period following ALL vaccines.

That’s an increase of almost 5,000% in Road traffic accidents for 2021, and a 6,500% increase in traffic deaths for 2021, when the COVID-19 experimental shots were being injected into Americans, as compared to all FDA-approved vaccines from the previous 10 years.

Is Your Car Recording You? Tesla Employees Admit to Sharing Photos and Videos of Owners Including "Intimacy", Kids, and Location

Is your car recording you? If you own a late model car today, chances are pretty good that it is, because all modern cars today are connected to the Internet for the transmission of data, and these modern cars are also often equipped with several cameras.

Tesla cars can have up to 9 cameras, and now an explosive report published by Reuters this week, who interviewed several former employees from Tesla, confirms that Tesla vehicles have the ability to record and transmit what goes on both inside, and outside the vehicle.

These employees admitted that they often shared hilarious, and sometimes embarrassing, videos of Tesla owners among themselves in their own private chat network.

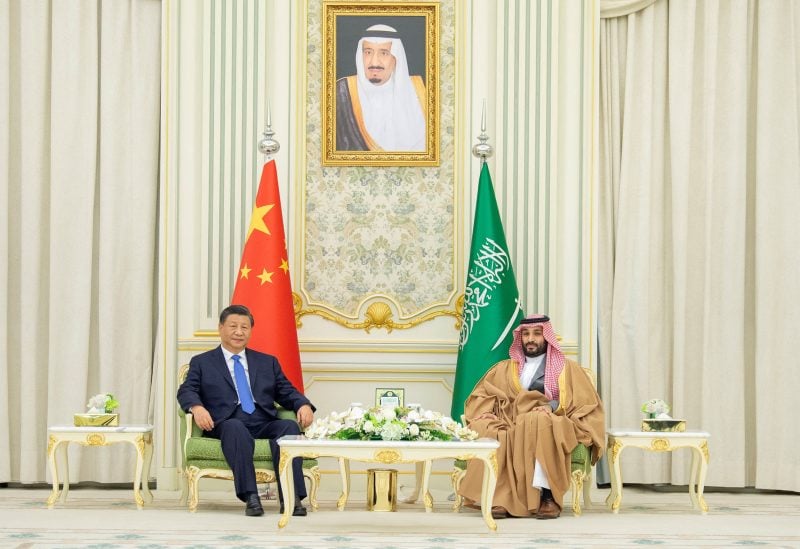

Beijing and Moscow are Uniting the Middle Eastern Oil Rich Countries - Sunni and Shia Muslims Making Peace

We are living in unprecedented times. I think it is safe to say that nobody alive today has ever seen such a massive realignment of countries in the Middle East coming together to put aside their differences and start working together to try and stop the endless wars, and work together for economic prosperity.

And the two countries that are spearheading the uniting of these Middle Eastern countries, are China and Russia.

This was a historic week of new meetings between countries in the Middle East, many of which have been bitter enemies with each other, sometimes for hundreds, if not thousands of years.

Here is a brief summary of these historical events that took place this past week.

Protesters in France Burn Down BlackRock's Office

France faces another wave of widespread protests and strikes following an unproductive discussion between the prime minister and labor unions. The failure to reach a compromise on the unpopular pension reform, which extends the working years for individuals, has fueled two-and-a-half months of public discontent.

Hundreds of thousands of people protested against Emmanuel Macron’s pension reform to raise the minimum age from 62 to 64.

Pension protestors in France were gathered outside of BlackRock’s Paris headquarters. The protestors have now stormed the building.

Here are the current scenes from Paris…

Venture Capital Backed Substack Latest Big Tech Company to Report Huge Financial Losses

As we watch the collapse of Big Tech and their financial institutions, popular content platform provider Substack’s recent financial statements show that they too may soon be a casualty of reckless spending by Silicon Valley venture capitalists.

It was reported yesterday that recent financial filings with the SEC show that Substack is burning through cash too quickly, and they have been having a hard time raising new capital.

Substack has been in the news this week for another reason: a public argument between journalist Matt Taibbi, famous for publishing “The Twitter Files,” and the current owner of Twitter, Elon Musk.

Taibbi has stated he is leaving Twitter over alleged censorship on Twitter regarding Substack writers, something Elon Musk denies.

As much as Taibbi and others are trying to frame this conflict as censorship by Twitter over Substack because they are afraid Substack is going to compete with them, the evidence seems to point to the opposite, given the fact that Substack is reported to be bleeding huge financial losses, and that venture capital firms turned them down in 2022 to raise more money.

That includes Andreessen Horowitz, who is heavily invested in BOTH Twitter and Substack, as well as Elon Musk himself, who reportedly had an opportunity to buy Substack last year, but declined.

All the evidence points to the same kind of financial troubles that other Big Tech companies are currently suffering which is leading to massive layoffs: “cheap money” has now disappeared since the Fed began raising interest rates, and these bloated Big Tech companies have been caught with their pants down, showing that their business model of investing first, and hoping you can earn a profit later, just won’t work anymore.

Big Tech Fail: Not Enough Computers in the U.S. to Develop New AI Software

I recently reported how America’s faith in Artificial Intelligence (AI) is about to destroy the U.S. economy, as investors are pouring $BILLIONS into developing new AI software, which is projected to be a $1.59 TRILLION industry by 2030.

And news continues to be reported on just how much of a fantasy this faith in AI, and technology in general, is, as we are being setup for perhaps the largest economical bubble to burst in the history of the U.S.

Today, The Information confirmed one of the reasons I gave for a possible imminent collapse of the Tech sector based on this rush into AI: there aren’t enough computers in the U.S. to run all of this new, power hungry, desire for these new AI toys that do NOT produce any revenue yet.

“AI Developers Stymied by Server Shortage at AWS, Microsoft, Google – Startups and other companies trying to capitalize on the artificial intelligence boom sparked by OpenAI are running into a problem: They can’t find enough specialized computers to make their own AI software.

A spike in demand for server chips that can train and run machine-learning software has caused a shortage, prompting major cloud-server providers including Amazon Web Services, Microsoft, Google and Oracle to limit their availability for customers, according to interviews with the cloud companies and their customers. Some customers have reported monthslong wait times to rent the hardware.

Cloud providers expanding their data centers also are running into problems getting enough energy sources to power them, according to a February report from commercial real estate firm CBRE.”

The Technology Community here in 2023 has obviously not learned the lessons from the Big Tech bubble burst and economic fallout in the early 2000s, and this bubble looks to be a lot worse, given how their largest bank, Silicon Valley Bank, has already failed, and many other banks in the U.S. are on the brink of collapse.

These gigantic Tech companies, such as Apple, Google, Amazon, and Microsoft, are running most of the economy today, and if they crash, so does America.

Here is more evidence that Big Tech is recklessly overspending what is left of America’s wealth, and that our reliance on Technology could be close to collapsing what is remaining of the American Empire.

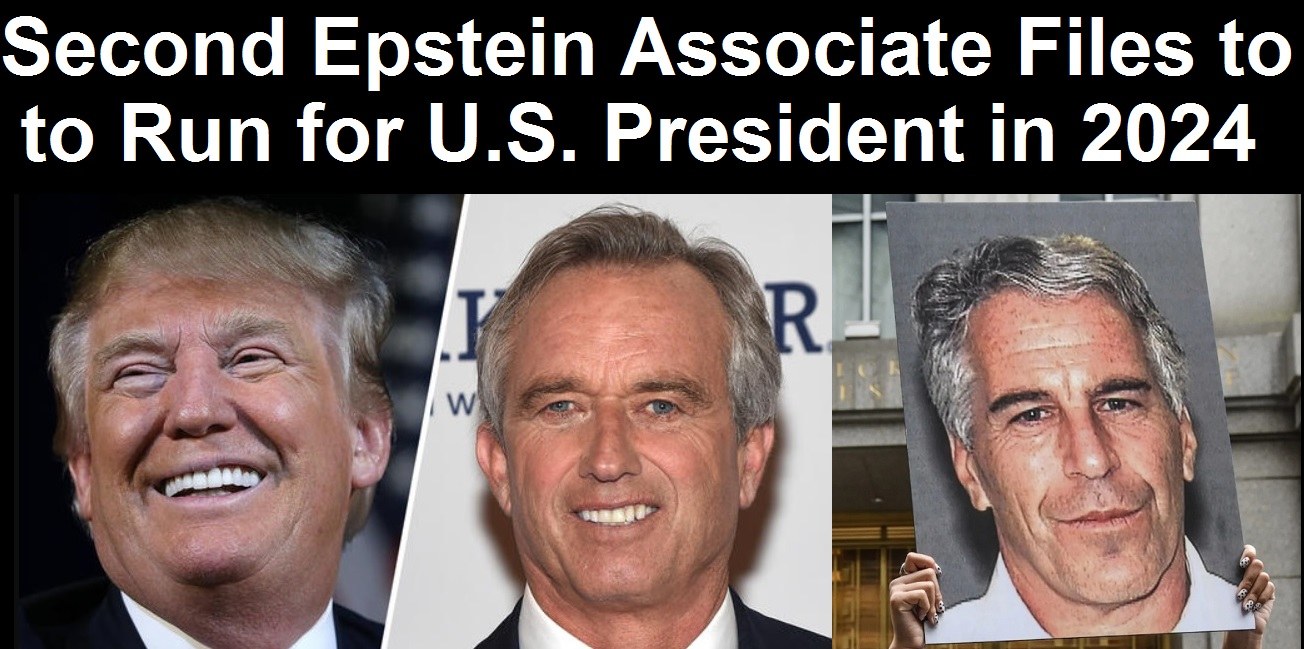

Another Former Associate with Jeffrey Epstein Files to Run for U.S. President in 2024

It has been widely reported today that Robert F. Kennedy, Jr. has filed to run for the office of the U.S. Presidency in 2024, giving Americans two candidates now, one in each party, who are former associates with convicted child sex trafficker Jeffrey Epstein and are running for President.

Just about everyone in the alternative media who has covered this announcement by RFK Jr. sees this as wonderful news, while the corporate media, which seem to be following some kind of script or press release, are all writing basically the same thing and choosing to just criticize his “anti-vaxx” positions.

This “negative” media coverage will of course only strengthen Kennedy’s support in the alternative media which thrives on negative news against the COVID shots.

What is lacking in all of this media coverage is the abundance of publicly available information about RFK Jr.’s troubled past with sex and drugs, much of which was published back in 2015 by New York Times bestselling author, Jerry Oppenheimer, and his book: RFK Jr and the “Dark Side of the Dream”, which the New York Daily News described as “A bombshell unauthorized biography tells the haunting past that kept Kennedy from following in his father’s footsteps.”

So a member of the incredibly famous Kennedy family, who just a few years ago was considered by most in the media as “unelectable” and has never previously held a public elected office before, is now being funded by a wealthy Silicon Valley Technocrat who apparently believes that he can buy a U.S. President.

Canadian Funeral Director and Embalmer Testifies About "Dirty Blood" Found in Bodies Post COVID Vaccinations

Laura Jeffery is blowing the whistle on what she has been finding as a funeral director and embalmer in the post-novel injection world, and wonders why no one else is doing the same.

Embalmers use a technique that drains the circulatory system of deceased patients and fills it with preservation so “that we can present a person that is reasonable to how their appearance should be,” said Jeffery.

“I started to notice anomalies to what the return was – the return blood was stickier, thicker, darker and I started seeing little tiny pieces of clot like polka dots coming out… there was something different. I would call it ‘dirty blood.'”

The Data Missing from Wall Street Economists: Skyrocketing Disabilities and Injuries in U.S. Workforce After COVID-19 "Vaccines"

The word “unprecedented” is being used more and more in financial news stories these days to describe the economy, and on financial news sites you can often read articles describing the same thing, but interpreting the data in completely opposite ways.

Take the “jobs market” data which has been the focus of many financial news stories this week. Depending on which articles you read on the same website, the data that is being released this week on jobs and unemployment either means the labor market is in decline, or that it is “too strong.”

A recent survey published on “investor-satisfaction” led to an article published this week stating that “Investors are mad as hell at advisers.”

Well, one reason why financial “experts” might be having such a hard time interpreting the current economic data is that certain topics are politically incorrect to discuss, and perhaps the biggest topic that nobody in the corporate media wants to address is the topic of deaths and injuries due to the roll-out of the COVID-19 “vaccines” in 2021.

If a reporter at any of the corporate news outlets even hints at the possibility that the COVID vaccines are killing and disabling people, their career would be pretty much over.

But if one does not factor in how many people were either removed from the labor force due to vaccine deaths, or are injured and disabled from the COVID shots, how can you accurately interpret the economic data??

Edward Dowd and his team at Phinance Technologies seem to be the only ones spending time crunching this data and publishing it, and Dowd recently wrote what the CONSERVATIVE estimates are at this point from evaluating the data:

“Using the conservative numbers from our vaccine damage report for US and assuming globally that 5 billion were vaccinated here are extrapolated estimated human costs globally:

Deaths: ~5 million – Disabilities: ~46.5 million – Injuries: ~900 million.”

And these groups are not static.

No wonder Wall Street analysts are having such a difficult time interpreting the economic data, and often publishing contradictory information: they are missing this key data that Dowd provides, but which is politically incorrect to even acknowledge, let alone analyze.

And one of the most amazing things here is that Edward Dowd is providing the data that his team has collected to the whole world for FREE!!

DISASTER! Food Shortages & High Inflation for Contaminated Food Threaten Nation's Food Supply

In what is still probably one of the most under-reported breaking news stories in the U.S. today, the situation with the flooding in California, which produces 50% of the nation’s agriculture, is going from bad to worse, while other parts of the nation are still in drought conditions which threaten the nation’s winter wheat crops, it was reported today.

And then there was a report published in the LA Times yesterday which revealed that thousands of tons of “human waste” are transported about 8 times a day to Tulare County farmlands to convert into fertilizer, and that “waste” is now threatening to spread to California’s water system, as record levels of snow in the Sierra Mountains start to melt and cause further flooding in the farms of Central California.

“Human waste” is a polite term to use for what this “sludge” is that now threatens $billions of food in California farmlands.

Here is how Wikipedia defines it:

“Human waste (or human excreta) refers to the waste products of the human digestive system, menses, and human metabolism including urine and faeces.”

And all of this “human waste” is in ADDITION TO the “waste” produced in Central California from huge dairy and poultry operations, which now also are in danger of spreading into California’s water supplies.

Are the Days of Ishmael Here? Global Finance Leadership Takes a Turn East, to the Arab Middle East

If Saudi Arabia did not appear in your news feed for the past two days, then you have missed what has been perhaps one of the most important news stories of not only the past couple of days, but perhaps of the past year, if not the past decade or century, while most of the U.S. population is being distracted by entertainment news as the clown circus show in Florida took their act to Manhattan today.

First, out of nowhere, Saudi Arabia shocked the western financial world yesterday (Sunday, April 2, 2023), by announcing that OPEC was going to reduce oil production by over 1 million barrels per day.

The U.S. financial news publishers were very busy today trying to process what just happened. There are concerns that this move will now cause more inflation in the U.S., and hasten the collapse of the banking system.

And as if the announcement of the OPEC production reduction wasn’t already enough major breaking financial news on the first Monday in April, there is this explosive report published by The Information today: “Saudi Arabia Discloses Ties to Andreessen Horowitz, Dozens of Other Venture Funds”

Wow!! Talk about timing for Saudi Arabia to come out in the open and reveal that they have made massive investments into Silicon Valley venture capitalists for the past several years!

As Health Impact News readers well know after my headline article yesterday, since the banking crisis started last month, the Tech sector has been mostly holding up the economy in the U.S., mostly based on all the hype surrounding new Chat bot artificial intelligence development, which doesn’t even have a working model yet to produce revenue.

And now we find out today, the day after OPEC announced they are reducing oil production which will almost guarantee inflation will increase, and potentially spell doom to America’s small and regional banks, if not collapse the entire banking sector, that Saudi Arabia has been one of the major contributors of liquid assets into Silicon Valley?

Will they continue to invest in Silicon Valley and prop up the U.S. economy?

The entire U.S. economy now seems to be in the hands of Saudi Arabia.

So are the days of Ishmael here, and the fulfillment of God’s promises and prophecies made thousands of years ago to bless Ishmael, the son of Abraham and the father of the Arab people?

WARNING: Faith in Artificial Intelligence is About to Destroy America - A Total System Collapse May be Imminent

As we now enter the first week of the second quarter here in 2023, the United States stands on the brink of a total financial collapse.

There are many ways to view the current economic crisis we all face, and the economic factors that have brought us to this point today, such as the steps that were taken in 2008 during the last economic crisis which never solved the problem, but only kicked the can down the road until the crisis grew bigger, or the role that COVID policies played starting in 2020, or the myriad of other factors that have led us to the place where we all stand today.

But the view that I choose to write about and explain, since so few others are writing about it, is the Big Tech collapse that began in 2022, with the blowup of the FTX cryptocurrency exchange, and the massive layoffs that began in the world’s largest technology companies.

While it is hard to put a number on the total financial loss in the U.S. economy due to the FTX collapse, over $30 billion alone was lost just due to bankruptcies of some of the largest cryptocurrency exchanges.

And that does not include the two largest cryptocurrency exchanges, Binance and Coinbase, which today are in serious trouble and could also be facing failures and potential bankruptcy.

This crisis spread to the banking industry at the end of the first quarter this year, with banks heavily invested in the cryptocurrency market experiencing bank runs and collapse, including Silicon Valley Bank, which at the time was the 15th largest bank in the U.S.

And more banks face failure today, as the bank runs have not stopped.

But the markets haven’t crashed yet, partially because there is so much money in the system that the Fed has created since 2020. And not only has the U.S. stock market not crashed yet, the one sector that one logically would conclude is in the middle of massive correction, the technology sector, which investors should avoid like the plague, is the one sector that is actually increasing, even since the bank failures.

This sector, represented mostly on the NASDAQ, is holding up the entire financial system right now (at least as of the end of the last week in March), and I am not the only one questioning the logic of seeing Big Tech as a “safe haven” to park money into today.

So if Wall Street financial analysts are warning that Tech stocks are NOT a safe haven to put money into today, what is causing this faith in technology to continue drawing investors, which appears to be the only thing holding up the economy right now and stopping a complete financial collapse?

We don’t need to look far to see what is causing the latest feeding frenzy in technology these days, as it is in all of our news feeds on a daily basis: Artificial Intelligence Large Language Models (LLMs), such as ChatGPT.

LLM based Artificial Intelligence is believed to be a market that will grow to over $1.59 trillion by 2030.

However, as in all other technology financial bubbles in the past, all of this money is being bet (not “invested”) on the future, not the present, because all we have today are prototype models that don’t even work correctly.

In spite of all the hype you are reading on a daily basis regarding the latest “AI technology” with these chat bots, they are not actually producing any revenue yet.

They are simply sucking up much of the remaining capital in the U.S. market.

And now, the chat AI products are in position to be perhaps the biggest financial bubble of all time, and when it bursts, which could be tomorrow, next week, next month, or perhaps not until the end of 2023 or first quarter of 2024, it most definitely could bring down the entire financial system in the United States.

Google Co-Founder Among Billionaires Subpoenaed in Jeffrey Epstein Case

Billionaires Sergey Brin, Thomas Pritzker, Mortimer Zuckerman and Michael Ovitz were issued subpoenas this week by the US Virgin Islands as part of its lawsuit against JPMorgan over the bank’s relationship with now-deceased pedophile Jeffrey Epstein, according to the Wall Street Journal, citing people familiar with the matter.

The subpoenas seek any communications or documents related to JPMorgan and Epstein.

JPMorgan is being sued by the US Virgin Islands along with several Epstein accusers in a combined case over Epstein’s sex trafficking operation. The plaintiffs claim that the bank facilitated abuse by allowing Epstein to remain a client while helping send money to his victims. The lawsuit also alleges that JPMorgan turned a blind eye to Epstein’s activities after receiving referrals for high-value business opportunities.

Is the War in Syria Intensifying? U.S. Carrier Strike Group Deployment Extended as U.S. Troops Suffer "Brain Injuries"

America’s resolve to hang on to oil fields in Syria that former President Donald Trump seized in 2019 seems to be intensifying as the U.S. military has extended the deployment of the George HW Bush Carrier Strike Group, which has been under NATO command since last year, and is currently in the Mediterranean Sea.

The George HW Bush Carrier Strike Group replaced the Harry S. Truman Carrier Strike Group in the Mediterranean Sea last year.

We reported on the original deployment of Harry S. Truman Carrier Strike Group to the Mediterranean Sea under NATO command last year, because it marked the first time that U.S. Navy forces based in Norfolk, Virginia were being commanded by a non-American as part of NATO.

This followed the annexation of the U.S. Naval base by NATO in 2021, even though the base is on U.S. soil.

It is also now being reported that some American troops in Syria are suffering from “traumatic brain injuries” after recent attacks in Syria.

This is not the first time U.S. troops based in the Middle East have suffered from these types of “traumatic brain injuries.”

In 2020, American troops stationed in Al Asad Air Base in Iraq came under attack when Iran launched 15 ballistic missiles on the base in retaliation for a U.S. drone strike that killed Maj. Gen. Qassem Soleimani, the commander of Iran’s Quds Force military branch.

Troops there also suffered “traumatic brain injuries,” but then President Donald Trump and others refused to acknowledge the injuries for over two years.

This latest round of conflicts in Syria follows major announcements in the rapidly changing geopolitical makeup of the Middle East, where Saudi Arabia has put aside decades of conflict with Iran and has also agreed to start selling oil to China in China’s currency, rather than U.S. dollars.

Turkey is another major player in the Middle Eastern oil conflicts, and they just announced this week that they were closing down their pipeline pumping oil out of Iraq due to ongoing conflicts with the Kurds in northern Iraq.

This action by Turkey has allegedly taken 450,000 barrels per day of crude exports out of the market.

The American Empire is crumbling, as is their control of Middle Eastern oil.

China And Brazil Strike Deal To Ditch The US Dollar

According to the Brazilian government, China and Brazil have reached a deal to trade in their own currencies, ditching the United States dollar as an intermediary entirely, AFP reported.

The deal, Beijing’s latest salvo against the almighty greenback, will enable China, the top rival to US economic hegemony, and Brazil, the biggest economy in Latin America, to conduct their massive trade which amounts to $150 billion per year, and financial transactions directly, exchanging yuan for reais and vice versa instead of going through the US dollar.

In doing so China extends its bilateral, USD-exempting currency arrangements beyond countries such as Russia, Pakistan and Saudi Arabia to now include the Latin American exporting powerhouse.

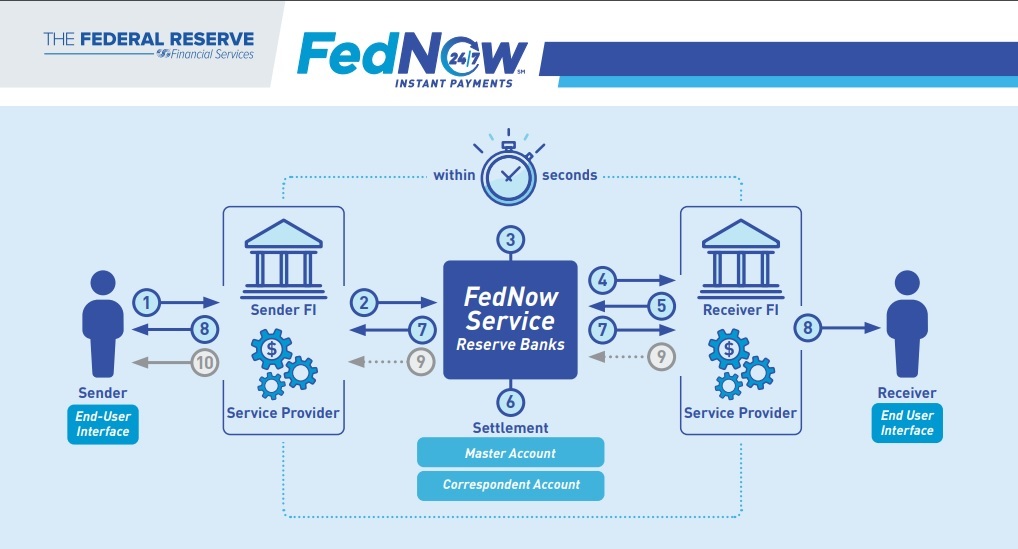

No Fooling: The End of "Private Banking" Starts Today with Bank Enrollments in the New FedNow Program

The first week of April, 2023 marks the beginning of the enrollment and certification process for financial institutions to start participating in the Federal Reserve’s new FedNow “Instant Payments” services, which is scheduled to launch in July, 2023.

While many in the alternative media (myself included) have linked the FedNow program to Central Bank Digital Currencies (CBDCs), technically speaking, FedNow is NOT part of the development of CBDCs.

Michelle Bateman, Director of Product Management, Payments at Finastra, is a member of FedNow’s pilot program, and she has stated that the project to develop CBDCs is completely separate from the FedNow Instant Payment service.

The main difference is that once CBDCs are rolled out, consumers will have accounts with a Federal Reserve Bank, while the FedNow program does not. The FedNow program will be offering “Master Accounts” at the Federal Reserve for financial institutions only.

However, as I have previously stated, rolling out CBDCs is a mammoth project, and cannot be done overnight. It would be foolish to not believe that the FedNow program is not a stepping stone towards CBCDs.

As you can see from the flow chart at the top of this article, with the implementation of the FedNow Instant transfer program, all the data involving a financial transaction between two “End-Users” will flow through the Federal Reserve banks.

So while they are advertising the FedNow program as a new system that will make payments and wire transfers much quicker and much more convenient, it is also a mass data collection system for the Fed to begin storing private bank information.

Will this include all the personal details of account holders in private banks?

All the Many Ways Big Tech is Selling Your Data to the Government Who is Spying on Americans without Warrants

I am not going to cover the RESTRICT Act proposed legislation regarding TikTok, since just about everyone else in the alternative and right-wing corporate media seems to be covering that story, but I am going to highlight some of the many ways the U.S. Government already purchases data from Big Tech and spies on American citizens, illegally, without a warrant.

These articles are from the Cyber Vice topic, a great source of information on the darker side of Tech.

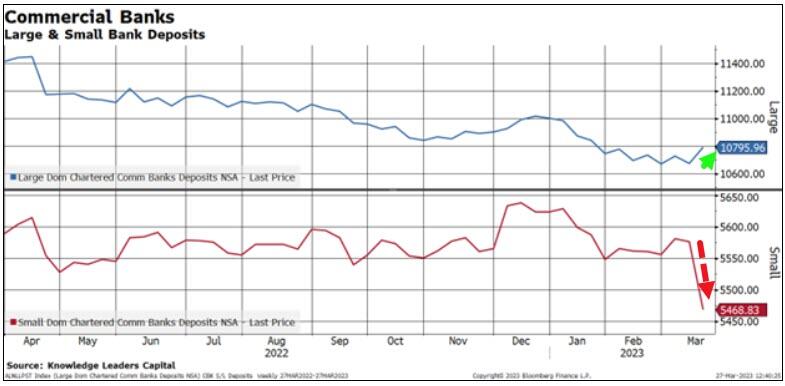

Second Wave of Bank Runs Start - Demise of the U.S. Dollar as the World's Reserve Currency Accelerates

It’s been over a week now since a bank has failed, but according to multiple sources, that does not mean that the banking crisis is over.

In fact, many sources are reporting that bank runs are continuing, with a “second wave” of bank runs now going on.

As we have previously reported, these modern-day bank runs are not always as noticeable today in the digital era, as you don’t typically see people lining up at the banks to physically withdraw their money, as it all happens on the Internet.

And while today depositors are rushing into Money Market accounts, once the smaller banks start failing again, expect to see more money exit bank accounts, such as into the FedNow CBDC accounts scheduled to come online this summer, as well as into commodities such as Gold and Silver.

The rest of the world is, of course, noticing this, and some are beginning to trade with currencies other than the U.S. Dollar.

Will CBDC FedNow Put Regional and Smaller Banks Out of Business this Summer?

The failures of Silvergate Bank, Silicon Valley Bank, Signature Bank, and the current struggles of First Republic and Pacific West Bank have seen bank deposits flee to the perceived safety of large banks.

To make matters worse for banks, rising interest rates and easily accessible higher yielding alternatives exist like money market funds (MMF) or US Treasury ETFs.

These alternatives are now a few thumb taps and swipes away from depositors, making the near-zero rate of return on bank deposits much less attractive for many consumers and businesses.

These issues, plus the new FedNow service which is set to begin trial runs in July, could represent an uphill battle for banks to retain deposits.

The Federal Reserve’s new FedNow program will allow bank customers at 10,000 financial institutions to instantaneously transfer funds in and out of bank accounts on a 24/7/365 basis.

This is probably the biggest innovation since mobile banking and investment apps and will allow customers greater access to “their” money than ever before.

NATIONAL CATASTROPHE! California Farmers Suffering Record Losses from Flooding as "Worst is Yet to Come"

With the threat of a World War 3 escalation into a nuclear conflict, while the world’s financial system is on the brink of collapse, it is easy to see why a local, regional news story about the weather will not make national headlines.

But there is a local, regional story developing in California that I guarantee will eventually make national headline news, as the flooding continues with more heavy rain and snow this week, and with local officials declaring that in terms of the flooding and damage, “the worst is yet to come.”

With California producing over half of America’s agriculture, this is indeed HUGE news, as this is also going to affect food prices around the world, since many of California’s agricultural products, a $51 BILLION economy, are exported outside the U.S.

The main reason this is not a major worldwide headline, yet, is because there are still very few estimates as to how high the losses are going to be, since the farming community in California is just trying to survive right now, bracing for new storms that entered the State yesterday and are continuing today.

Total financial losses for the State of California due to flooding that began in January, right now range from $5 BILLION to $30 BILLION.

Saudi Arabia's Biggest Oil Producer Will Build $10BN Petrochemical Complex in China - Are the Days of Ishmael Upon Us?

There are very few people in the western media, both corporate and alternative, who seem to fully understand the significance of the announcement this week that Saudi Arabia’s largest oil company, Aramco, is investing $BILLIONS in China’s growing petrochemical industry.

Aramco was originally the name for the “Arabian American Oil Company,” founded by the Standard Oil Co. of California (Chevron) in 1933, when the government of Saudi Arabia granted it a concession.

Other U.S. companies joined after oil was found near Dhahran in 1938.

In 1973, the Saudi government bought a 25% interest in Aramco, increasing that interest to 60% the following year.

In 1980, the Saudi government increased its interest in Aramco to 100%. Eight years later, the Saudi Arabian Oil Company (now renamed Saudi Aramco) was officially established.

I worked in Dhahran in the early to mid 1990s, teaching English at King Fahd University of Petroleum and Minerals. It is a huge university with around 10,000 students, and the entire curriculum is taught in English, hence the need for many English teachers.

But as large as the campus in Dhahran is, it is quite small compared to the Aramco company compound directly next to the University. We had many American (and Filipino) friends at Aramco back then, and often visited them at the Aramco compound.

Driving into the Aramco compound was like driving into the suburbs of a modern U.S. city, where you could literally find all the same comforts you could find in the U.S., even though you were out in the middle of a desert. Even the women there drove cars at that time, while outside the compound, it was forbidden (at that time).

Back in the 1990s, Americans still mostly ran the company, as they transitioned to Saudi management and more members of the board of directors came from the Saudis.

But things are very different today, as this announcement of investing in China clearly demonstrates. Gone is the respect for the Rockefeller oil industry and their puppet politicians, as recent comedy skits produced by Saudis mocking Joe Biden clearly show.

So are the days of Ishmael here, and the fulfillment of God’s promises and prophecies made thousands of years ago to bless Ishmael?

Is the Collapse of NATO Imminent? A Non-Western Dire Warning

It is difficult for those of us currently residing in the United States to get an accurate account about how the war in Ukraine is actually going, as it depends on which sources you read and trust.

I don’t think it can be disputed, however, that the economy of NATO nations is in serious trouble with massive bank runs and failures, and massive demonstrations in many countries with the country of France literally burning and basically shut down, while non-NATO countries such as Russia, China, Saudi Arabia, and Iran, are already on the road to economic recovery as they band together to oppose the ongoing wars and economic sanctions funded by the Davos Crowd.

For a non-Western perspective on what is basically the beginning stages of World War 3 as it unfolds before us in real time today, I am publishing a commentary by Sam Parker of Behind the News Network entitled “The Demise of Nato.”

Consider this commentary as a “worse case scenario,” as Parker believes that Russia absolutely has the power to destroy the United States, even without launching nuclear weapons, by bombing key infrastructures, like they are currently doing in Ukraine.

He writes:

“Few people – including CIA operatives – may know that New York City, for instance, may be destroyed with a single move by blowing up the George Washington Bridge. The city can’t be supplied with food and most of its requirements without the bridge.

The New York City electrical grid can be destroyed by knocking out the central controls; putting it back together could take a year.

America is fragile. We don’t notice because it works smoothly and because when a local catastrophe occurs—earthquake, hurricane, and tornado—the rest of the country steps in to remedy things.

The country can handle normal and regional catastrophes. But nuclear war is neither normal nor regional. Very few warheads would serve to wreck the United States beyond recovery for decades.

This should be clear to anyone who actually thinks about it. Defense is impossible. Coastal cities are particularly easy targets, being vulnerable to submarine-launched sea-skimming missiles – Washington, New York, Boston, San Diego, Los Angeles, San Francisco, Seattle for starters – all gone.

A modern country is a system of systems of systems, interdependent and interconnected—water, electricity, manufacturing, energy, telecommunications, transportation, pipelines, and complex supply chains. These are interconnected, interdependent, and rely on large numbers of trained people showing up for work.

Talking of repair any time soon after the nuclear bombing of a city is foolish because the city would have many hundreds of thousands of dead, housing destroyed, massive fires, horrendously burned people with no hope of medical care, and in general populations too focused on staying alive to worry about abstractions like supply chains.”

Crypto Takedown Accelerates as World’s Largest Cryptocurrency Exchange Binance Sued by U.S. Government

It is looking more and more each passing day that the U.S. financial system is speeding into a consolidation of the Big Banks, as their war against cryptocurrencies appears to be now accelerating.

It was announced today that Binance, the world’s largest cryptocurrency exchange, along with their Chief Executive Officer Changpeng Zhao, are being sued by the US Government.

The lawsuit was filed by the US Commodity Futures Trading Commission for “Willful Evasion of Federal Law and Operating an Illegal Digital Asset Derivatives Exchange.”

This follows a report last week, that Coinbase, the largest cryptocurrency exchange in the U.S., is also being threatened with a lawsuit by the Securities and Exchange Commission.

With the Davos Crowd’s financial system on the brink of ruin, they are doing everything they can to stop of the flow of bank runs and the exit of cash from their banks, such as into cryptocurrencies.

How much longer can the Davos Crowd keep propping up their failing banks?

Swiss Banks were once considered the safest place to stash wealth by the “elites” of Western Culture. But now some are calling Switzerland a “Banana Republic” after the raid on pension funds and the collapse of Switzerland’s second largest bank.

Netanyahu Backs Down, for now, to Avoid Civil War in Israel

A day after the largest protests in the history of modern-day Israel, most Israeli embassies were closed today, including their embassy in Washington D.C., to show support for the protesters in Israel.

In a much anticipated announcement, Prime Minister Benjamin Netanyahu made a speech at around 8 p.m. local time Monday night stating that the government would pause their judicial overhaul plans, in order to avoid a civil war. There are questions as to how much support he has in the military.

It remains to be seen if Netanyahu’s remarks will be enough to end the protests and strikes. Opposition organizers have reportedly stated that a “temporary” pause in the government’s plans to overhaul the judiciary are not enough.

Largest Protest in the History of Israel as Hundreds of Thousands Take to the Streets

Massive protests have erupted across Israel tonight after PM Netanyhau fired his Defense Minister, a day after he called on the Israeli leader to halt a planned judicial overhaul that has fiercely divided the country.

As a reminder, Netanyahu and his allies say the plan will restore a balance between the judicial and executive branches and rein in what they see as an interventionist court with liberal sympathies. But critics say the constellation of laws will remove the checks and balances in Israel’s democratic system and concentrate power in the hands of the governing coalition.

Gallant’s dismissal signaled that Netanyahu will move ahead this week with the overhaul plan, which has sparked mass protests, angered military and business leaders and raised concerns among Israel’s allies.

Hundreds of thousands of Israelis took to the streets in Tel Aviv and Haifa. Saturday night’s crowds were reportedly the largest ever.

Will there be a military coup in Israel?

Americans Now Dying in Syria to Protect Syrian Oil Fields the U.S. Military Seized

Americans in the U.S. military and with military contractors came under fire in Syria this past week, suffering casualties from alleged Iranian drone strikes.

Why is the U.S. military still in Syria? It’s hard to say. No U.S. president since Barack Obama has offered a rational explanation. Syria continues to act as a remnant of establishment war-hawk policies from the Bush era, with Obama, Biden and Hillary Clinton using the conflicts in Iraq and Afghanistan as a jumping-off point for their covert Arab Spring operations.

In infamous comments made in 2019, former U.S. President Donald Trump said: “We’re keeping [Syria’s] oil. We have the oil. The oil is secure. We left troops behind only for the oil.”

Was President Trump’s seizure of Syrian oil fields in 2019 legal?

The attacks on the U.S. military bases in Syria followed the recent announcement that Saudi Arabia was normalizing relations with Iran, a peace initiative brokered by China. Saudi Arabia announced last week that they would reopen their embassy in Syria.

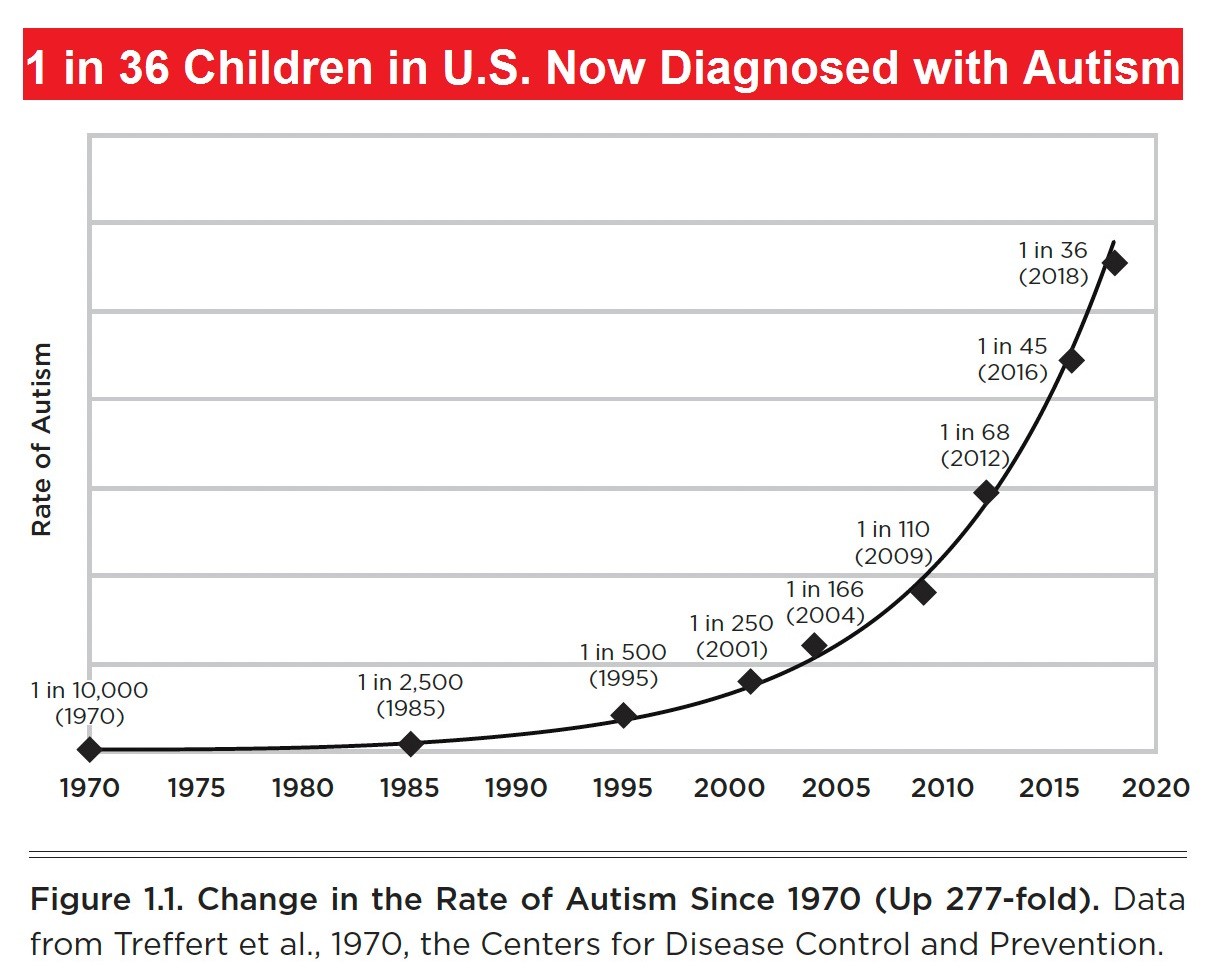

1 in 36 Children in the U.S. Now Diagnosed with Autism but CDC Refuses to Look at Vaccines as Cause

A brand new study was released today by Centers for Disease Control pegging the autism rate in the United States at 1 in 44 children, up from 1 in 150 children in 2000 when their complex surveillance system—The Autism and Developmental Disabilities Monitoring (ADDM) Network—was first instituted.

Looked at another way, that means 2.7% of children today have autism, and the rate has grown by 243% since 2000.

In the old days, people panicked when they saw a devastating disability amongst our children increase by 243%. But, the CDC isn’t worried, their “Public Health Action” from the study is unfortunately par for the course:

The continued increase among children identified with ASD, particularly among non-White children and girls, highlights the need for enhanced infrastructure to provide equitable diagnostic, treatment, and support services for all children with ASD.

Any question in the report about WHY the rate has increased so much? Of course not. But, it actually gets worse.

Russian Soldiers Discover "Baby Factories" in Ukraine where Young Children are Grown for Child Sex Brothels and for Organ Harvesting

A video has surfaced of Russian soldiers describing how they found a “baby factory” in Ukraine where young children are raised for the pedophile child brothels, or murdered to harvest their organs and sell on the Black Market.

The video was published by The People’s Voice, and they mention how other sources in Russia have covered this issue, and that Western Media just excuses it as disinformation or propaganda.

But Russians are not the only ones who have documented this horrible practice of trafficking babies and young children for sex and then murdering them for their body parts.

Two years ago we published the documentary published by Polish film producer Patryk Vega, called “Eyes of the Devil.”

In this documentary, Vega is able to actually interview one of the child traffickers who trafficks babies from Poland and Ukraine to child brothels in Germany, where the children, usually around 5 to 7-years-old, work for a few years in the brothels until their tiny bodies start to break down, and then they are murdered to harvest their organs which are trafficked to the rich and powerful.

Southwest Airlines Flight Diverted as Pilot Collapsed Shortly After Takeoff - 5th Pilot Collapse in Past 3 Weeks!

Pilot Josh Yoder reports: “I’m being notified by passengers on a Southwest flight departing Las Vegas that the captain became incapacitated soon after takeoff this morning. He was removed from the flight deck and replaced by a non Southwest pilot who was commuting on that flight.

This is now the fifth pilot incapacitation that I’m aware of in the past two weeks.”

Central Bank Digital Currency Fail? Worldwide Resistance Against Central Banks Gains Momentum

Is the fear over the adoption of Central Bank Digital Currencies (CBDCs) being over-hyped?

Nigeria has been used by some as an example of what may be coming to the U.S. in terms of rolling out a CBDC, as Nigeria is the first major country to do a mass rollout of CBDCs and attempt to replace cash.

But now one year later, it appears that the rollout of the Nigerian CBDC, the eNaira, has been a total failure, as their Supreme Court has ruled it is “unconstitutional,” and there are calls for arresting the head of the Central Bank in Nigeria.

And in an article published today, March 23, 2023, it is being reported that the Nigeria Labour Congress is calling for public sector workers to start a nationwide strike next week, protesting at Central Bank branches, which could cripple the entire country.

Within the past 30 days or so, several U.S. politicians have also come out publicly against Central Bank Digital Currencies.

They include: U.S. Congressman Tom Emmer, South Dakota Governor Kristi Noem, Florida Governor Ron DeSantis, and Texas U.S. Senator Ted Cruz.

What do these four politicians all have in common?

They are all Republicans. You know, the party that used to hold the position that “all vaccines are safe and effective and the science has been settled,” which was the position of ALL politicians, both Democrats and Republicans, until it was decided by the GOP in 2022 that it was OK to oppose one kind of “vaccine,” the COVID shots, and therefore made it a political issue.

And of course they only adopted this position AFTER hundreds of millions of Americans had already received their shots.

This GOP position on the COVID shots, however, did not result in any action to either STOP injecting Americans with COVID-19 bioweapons, nor hold accountable those who approved them.

So do we now trust them on their opposition to Central Bank CBDCs?

America's Faith In Technology is Leading the Financial Collapse of a Once Great Country

Today’s meeting of the Federal Reserve and their announcement regarding interest rates was, by far, the most anticipated financial announcement so far in 2023.

Since the start of the banking collapse of the past couple of weeks, there has been widespread speculation about what the Fed was going to do today.

Would they announce rate cuts and the return of easy money, which would throw a life preserver out to America’s smaller banks, or would they continue with rate hikes in an attempt to lower inflation, but potentially doom hundreds of America’s smaller and mid-sized banks to collapse?

It was a no-win situation for the Fed, and most were anticipating at least a halt in rising interest rates, if not the announcement of rate cuts.

In the end, the Fed announced another rate increase, stating that rate cuts were not on the table for the rest of 2023.

Trying to calm the nerves of investors on Wall Street, Federal Reserve Chairman Jerome Powell announced that “all depositor savings” were “safe,” and that they were prepared to “use all tools” to keep the U.S. banking system “safe and sound.”

However, Treasury Secretary Janet Yellen, who was testifying before a Senate Appropriations subcommittee at the same time Powell was making his remarks, was asked if the FDIC was going to raise the limit on bank deposits that are insured above the current $250,000 limit, and she replied:

“This is not something we have looked at, it’s not something that we’re considering.”

Whoops! The stock markets then began a steep decline in the final hour of trading, as soon as she said that.

Bank stocks tumbled once again, but they are not the only ones looking at disaster. The automobile industry and the housing market is also in big trouble now, as U.S. consumers’ ability to borrow money and make major purchases will now get even worse.

And just as a reminder, this current crisis of liquidity and downward spiral all began last year when FTX blew up, and the Big Tech sector began massive layoffs.

Big Tech’s main bank, Silicon Valley Bank, the 15th largest bank in the U.S., was the first to crash.

And now, America’s reliance on technology is crippling this nation, and it can only get worse, as all of this technology, such as AI which is eating up $billions of cash in Chat bot and other software right now, is all dependent upon hardware, and most of that is produced in China and Taiwan.

China can now easily cripple the United States and bring us to brink of collapse, without firing a single shot or launching a single missile, by simply cutting off their exports to the U.S., and blocking exports from Taiwan.

Central Banks are out of Ammo with no Choice but to let their Currencies Burn

At the beginning of last week, everyone expected central banks to “tighten until something breaks”. By the end of the week it was clear that they’d already broken everything.

Two middling US banks imploded, European mega-bank Credit Suisse finally died a well-justified death, and “who’s next?” speculation ran wild. And just like that, the era of tight money ended.

The piecemeal, fingers-in-the-dike character of this response can be explained in one of two ways: Either the morons running the global financial system were completely blindsided because they actually thought rising interest rates and a falling money supply would slow inflation without unintended consequences, despite a century of contrary experience. Or the evil geniuses running the global financial system have engineered a multi-faceted crisis as an excuse to assume total control.

Banks were already tightening credit standards before last week’s flash crisis. Now virtually all of them will stop lending to any but their strongest clients.

The number of underwater car loans, where the loan balance exceeds the value of the car, has been rising for months.

Commercial real estate was toast in any event, but now it’s burnt toast.

"An Extraordinary Change": Labor Data Reveals Shocking Drop In Workplace Attendance Following COVID-19 Vaccination Campaign

Last we heard from former Blackrock portfolio manager Ed Dowd and his deep-dive partners at Phinance Technologies, the rate of Serious Adverse Events reported during Covid-19 vaccine trials closely tracked a spike in disabilities reported following the vaccine’s official rollout.

In their latest analysis, Dowd and crew use data from the Bureau of Labor Statistcs (BLS) to reveal a shocking spike in both employee absence and lost worktime rates, which they believe is due to vaccines – either from primary vaccine injuries, or because of weakened immune systems due to the jab, and not long covid caused by the virus itself.

California Farmers: "We've Lost EVERYTHING" - $BILLIONS of Food Lost in Floods in State that Produces Half of America's Agriculture

Almost half of America’s agriculture is produced in the State of California, producing over 50 $BILLION annually in revenues.

Now, with recent historical and unprecedented flooding, many farmers in California are reporting that they have “lost everything.”

And it is not over yet, as the rains continue, and record amounts of snow in the Sierra Nevada mountains still need to melt, which will flow into farmlands that are already devastated in California’s Central Valley.

The emphasis today is still on saving people’s lives as the rain and flooding continue, and nobody knows yet what the final damages will be to America’s richest farmlands and how that will impact food security in the United States, and the nation’s already fragile economy.

I have put together a video report that is just under 15 minutes. I have friends and family members who live in this area of California, so I can confirm from first hand experiences that none of this is exaggerated. It is real.

This was a very emotional video for me to compile.

A New World Order is Emerging as the Davos Banking System Collapses

With the collapse yesterday of the world’s first SIFI (systemically important financial institution – “too big to fail”) bank, Credit Suisse, the reality that the financial system of western culture is now on the brink of collapse is starting to sink in with Americans.

While still not headline news in the American corporate media, financial headlines were notably pessimistic today, even with the stock market posting gains.

The more dire outlooks are still being published as “opinion pieces,” but it appears that more and more Americans are starting to face the reality that life as we have known it, is about to radically change.

Here is an article that was featured on the Home Page of Market Watch for most of the day today, while the markets were open. And while it is listed as an “opinion” piece, it sure reads like a news article to me.

“Opinion: The end of the ‘everything bubble’ has finally hit the banking system. Credit Suisse and SVB might be just the first of many shocks.”

The independent financial alternative media, without needing investors and editors’ approval to print anything, was much more apocalyptic. Here are a few headlines from ZeroHedge News today:

“The Banking System is On The Brink of Collapse,” “This Financial Crisis Will Be Like None Other In History,” “Nowhere To Hide In CMBS: CRE Nuke Goes Off With Small Banks Accounting For 70% Of Commercial Real Estate Loans.”

A New World Order is emerging, and it is NOT led by the Davos Crowd and the World Economic Forum.

Swiss Bank Fails! Bail-ins Implemented as Seniors' Pensions Raided - Chaos in Europe as France Burns

Credit Suisse, which was the second largest bank in Switzerland, and considered a “too big to fail” bank, has failed.

Swiss authorities rushed through a deal late Sunday in an attempt to prevent a whole-scale stock market crash before trading started in Asia, along with futures trading in the U.S.

The deal involved a forced fire sale to its rival bank, the largest bank in Switzerland, Swiss National Bank (SNB), which included both bailout money from Switzerland’s Central Bank for SNB, along with a bail-in of AT1 bonds with Credit Suisse used to fund seniors’ pensions, which will be completely wiped out.

The bail-in wipeout of senior pensions is sure to fuel protests already happening around Europe over pension reforms, especially in France where protests began Thursday night last week when President Emmanuel Macron invoked what is basically an “executive order” before the French Parliament was about to vote on, and DISAPPROVE, pension reforms.

The French have been rioting in the streets since then, continuing through Sunday night, as at the time I am writing this there are still livestream reports being broadcast showing much of France burning.

Could we see similar types of bail-ins and pension funds disappear in the U.S.?

Here is what the CEO of the largest investment firm in the U.S. said a few days ago…

Bailout Failure! Bank Runs Drain $550 Billion In Deposits In One Week - Are we Looking at an Infrastructure Collapse that will be Blamed on "Cyber Attacks"?

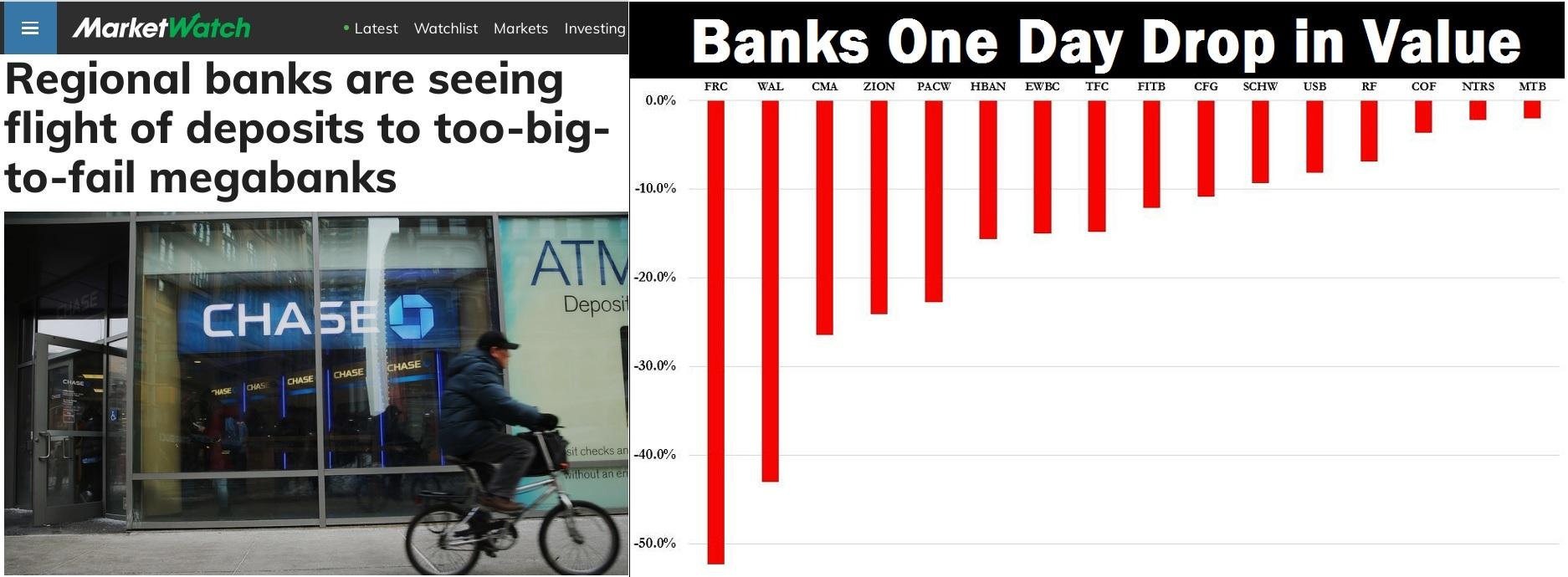

After a brief reprieve of declining bank evaluations yesterday (Thursday March 16, 2023) due to some of America’s largest banks stepping forward to provide an infusion of $30 billion for San Francisco’s troubled First Republic Bank, considered the next FDIC bank about to collapse, the financial system took another hit today in the Stock Market as it lost confidence in the ability of the larger banks to step forward and bail out smaller banks.

If anything, it appears more likely that the criminal banking cartel is about to consolidate their power by driving the smaller banks out of business.

And in the midst of bank runs and declining bank valuations this week, the Corporate Media published reports about possible cyber attacks being launched by Russia, according to a “research report” published by Microsoft.

Big Tech, which we previously reported is now controlling the country’s infrastructure in Ukraine, is also mostly running the operations for the U.S. military today.

So when you discuss private companies who receive $billions from the U.S. Government in defense contracts today, you need to add Microsoft, Amazon.com, Google, and Elon Musk’s Starlink, and other tech companies to the list of traditional private defense contractors such as Lockheed Martin, Raytheon, Northrop, etc.

If the U.S. Government cannot stop the bank runs and the collapse of the banking system, will they just turn to Big Tech to shut down the entire system, either by taking down the Internet or the electrical power grids, or both, and then blame it on Russia and use it as an excuse to start the World Economic Forum’s “Great Reset” agenda?

COVID-19 Drug Remdesivir Estimated to have Killed 100,000 Americans

John Beaudoin is calling for a criminal investigation into remdesivir citing data that it may have killed 100,000 people in America.

The US Food and Drug Administration (“FDA”) authorised the experimental antiviral drug remdesivir, brand name Veklury, for emergency use against covid-19 in May 2020. By October 2020, it had received full approval. It remains a primary treatment for covid-19 in hospitals, despite research showing it lacks effectiveness and can cause high rates of organ failure.

In mid-February, Beaudoin called for a criminal investigation into the drug, citing data for Massachusetts he estimates remdesivir may have killed 100,000 people in the US. “They know,” he tweeted, “or they wilfully refuse to know. Either way, it’s homicide.”

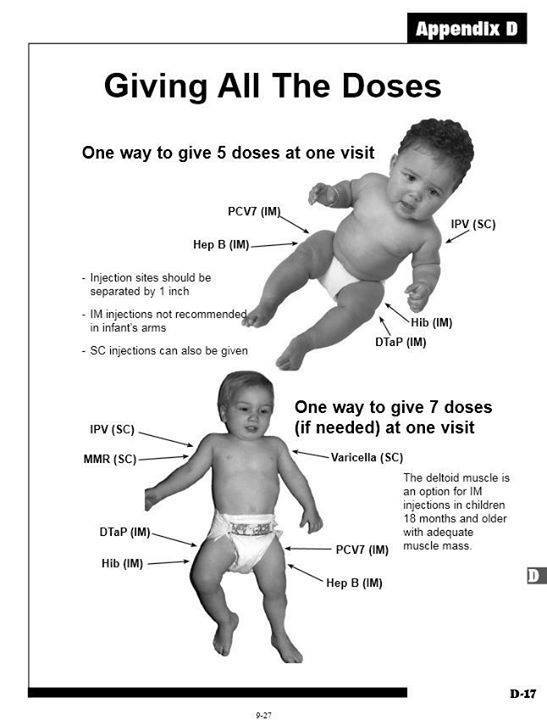

FDA Continues Infanticide-by-Vaccine Program Giving Emergency Use Authorization for 4th COVID "Vaccine" for Babies and Toddlers Under Age 5

With the financial system on the brink of collapse and the war in Ukraine intensifying and capturing the public’s attention this week, the FDA quietly gave a new emergency use authorization (EUA) for a 4th COVID “vaccine” booster for babies and toddlers under the age of 5.

With the EUA COVID shots now being added to the CDC Childhood Vaccination Schedule, a baby born in the United States can now have 42 doses of vaccines injected into them before the age of 5.

And if a child misses a few vaccines, or misses their “well-child” appointment with their pediatrician, no problem! As you can see from the image at the top of this article, pediatricians are trained to inject multiple doses into babies and toddlers during a single office visit, even though there are ZERO studies on the effects of injecting multiple doses of vaccines at the same time into babies and toddlers.

If the baby or toddler dies after these injections, it will be classified as “SIDS”, sudden infant death syndrome.

This is infanticide-by-vaccines, and a way of reducing the population, and it is already happening.

Here are a couple of records from the U.S. Government’s own VAERS (Vaccine Adverse Events Reporting System) database where young children were injected with the EUA COVID shots together with other vaccines, and the child died.

In the first case, a 6-month-old baby boy from Iowa was injected with 7 doses of vaccines (COVID + DTAP + HEPB + IPV + FLU + PNEUMO + ROTAVIRUS), and then died 10 days later.

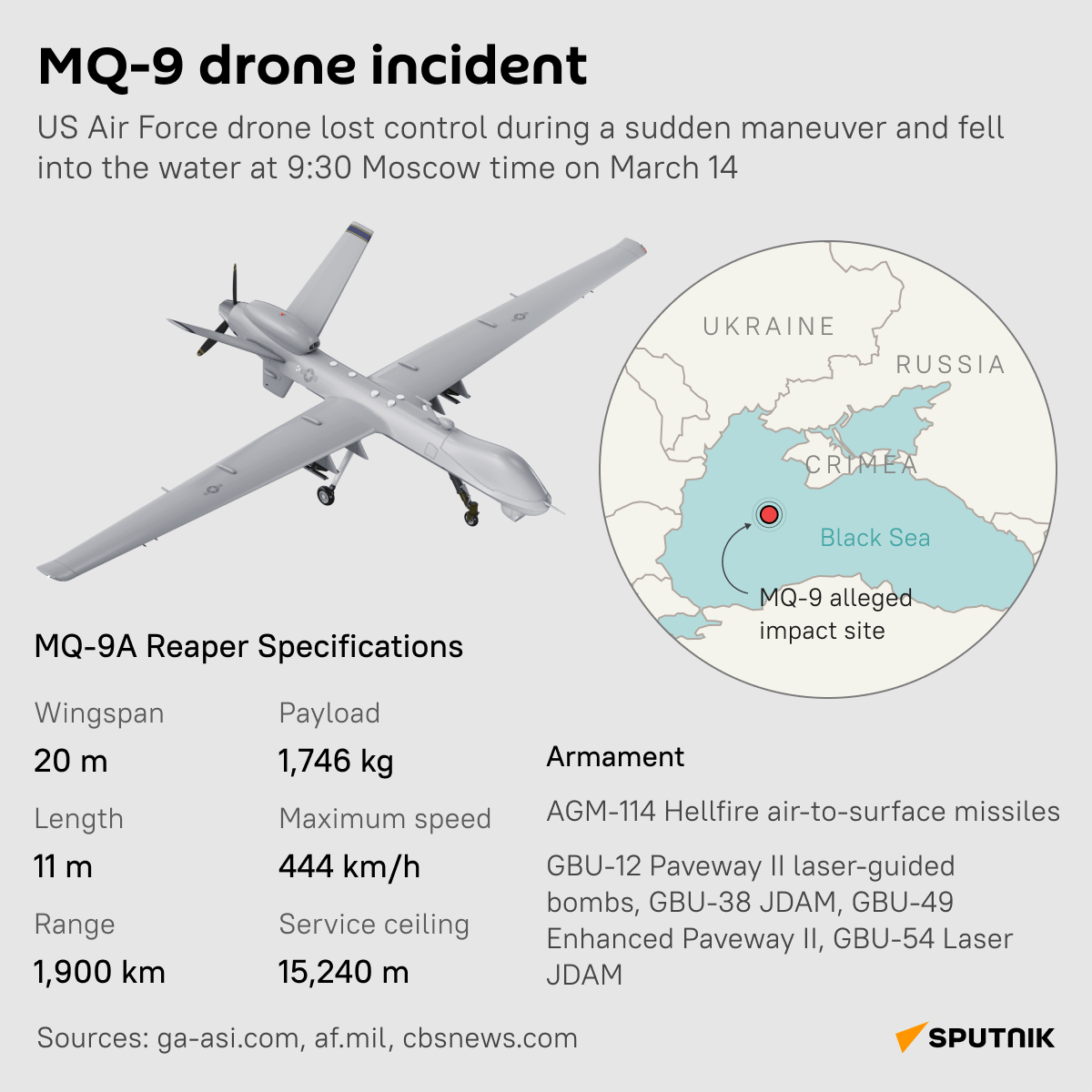

U.S. GOP Senator Calls for Shooting Down Russian Planes as War with Russia Escalates

As the world stands on the brink of a total financial meltdown, the U.S. corporate media was controlling the narrative in a different direction today focusing on the downing of a U.S. drone over the Black Sea that they claim was shot down by Russians.

U.S. Senator Lindsey Graham appeared on Fox News to state that the U.S. should now start shooting down Russian planes, because “that’s what Ronald Reagan would do,” and of course, this is all “Biden’s fault.”

Banking Crisis Worsens: Swiss Bank is First "Too Big to Fail" Bank to be Bailed Out as Saudis Withdraw Support

Switzerland’s second largest bank, Credit Suisse, which has been experiencing bank runs and plummeting stock valuations since the end of 2022, became the first SIFI (systemically important financial institution), or “too big to fail” bank, to crash today forcing regulators to step in and ensure a bailout.

The Saudis almost single-handedly crashed the U.S. Stock Market (and stock markets around the world) this morning when they announced that they were not going to put any more money into the failed Swiss bank.

While the U.S. Stock Market did end lower today, it most assuredly would have been a blood bath if Swiss Regulators had not stepped in to ensure the world that it was going to bail out their troubled bank. This was after European markets had closed, however, and European banks’ stock values lost 7% at end of trading in Europe today.

Since a simple statement made by Saudi National Bank Chairman Ammar Al Khudairy almost crashed the entire world’s financial system today, what does that tell you about the frailty of the current banking system?

Studio Guests Nearly Faint and Corporate Media Melts Down Over French TV Show Talking About Adrenochrome Drug Use Among Celebrities

The harvesting of blood from children to make drugs that allegedly help keep people young is not a conspiracy theory, but is something that is actually happening today among the rich and powerful.

We have previously published articles regarding “young blood” and the desire for these rich and famous people to find the “fountain of youth,” including Silicon Valley Billionaire Peter Thiel.

In an article we published in 2020, we reported how mainstream media sources outside the U.S. had begun to report on one of these drugs, the most notorious one, called adrenochrome, which is allegedly developed from blood taken from babies and very young children just before they are murdered, often as part of Satanic Ritual Abuse occult practices.

Turkish TV and others had begun covering this back in 2020, while the corporate U.S. media would probably never touch a subject such as this, and few in the alternative media will cover it either.

So I am not surprised to read about the reactions of a recent TV show in France where this topic was brought up.

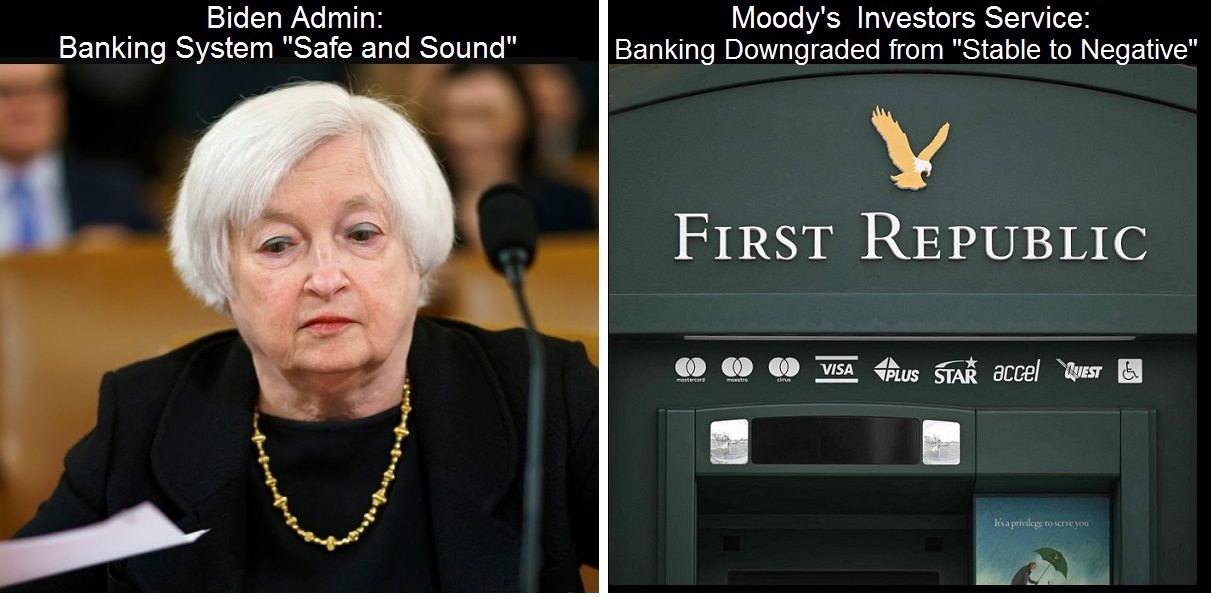

Moody's Downgrades Banking System from "Stable" to "Negative" - Crypto Takedown in Place with "Operation Choke Point"?

In spite of the fact that President Biden and U.S. Treasury Secretary Janet Yellen have told Americans that the U.S. Banking System is “safe and sound,” Moody’s Investors Service today announced that they had downgraded the U.S. banking system to “negative” from “stable” to reflect “the rapid deterioration in the operating environment.”

They also announced today that they were studying First Republic’s debt rating for a potential downgrade, along with five other regional banks.

Sifting through the plethora of news today regarding the banking industry’s woes, there are some who are now questioning why the Feds closed down Signature Bank on Sunday, when other banks appeared to be worse off.

This has led to speculation that cryptocurrency banks are being targeted, and the revival of the “Operation Choke Point” conspiracy theory.

Canada is now Giving COVID-19 Vaccines to Minors Without Parental Consent - Doctors are Now a Hazard to Your Child's Health

This evil practice of coercing children to accept COVID injections without their parents’ approval is not only happening in Canada, it is happening in the United States as well, as some states allow children as young as 12-years-old to get COVID injections without their parents’ knowledge or approval.

Bank Runs Continue as Multiple Banks on Verge of Collapse

While the Fed’s move yesterday (Sunday, March 12th) to bailout depositors from the Big Tech banks that crashed in recent days may have prevented a stock market crash today, it did not stop the bank runs, and more than 30 banks halted trading at one point today.

Most banking is done online now, so long lines at banks to withdraw funds are not something most are going to see these days. What is happening instead is that customers are withdrawing their funds from the riskier, mostly smaller banks, and putting them into larger banks that they believe are “too big to fail” because they believe the Fed will step in to prevent that.

While this is quickly turning into a partisan issue with each side blaming the other, open up your wallet and look at the color of your federal reserve notes (known as U.S. dollars). They are GREEN, not blue, and not red.

You “reap what you sow” is a fact of life, not only in agriculture (you can’t plant corn and expect to harvest watermelons), but also in the financial world, and after years of corruption in the business world and financial markets, the time to reap the consequences seems to be upon us.

America has prospered for too long off the backs of cheap labor outside the U.S. while investments and start up firms have become just as risky and worthless as gambling in Las Vegas, throwing money around as entertainment without producing anything of real value.

This is a MORAL issue, not a political issue. The time to pay off our debts that we have immorally been ignoring for decades, no matter which political office has been in power, is now upon us it would seem.

3rd FDIC-Insured Bank Fails in 5 Days but Feds Avoid Black Monday by Bailing Out Depositors

Sunday morning U.S. Treasury Secretary Janet Yellen appeared on Sunday talk shows to announce that the Fed was NOT bailing out Silicon Valley Bank or any other banks, as they did in 2008.

However, faced with the possibility of bank runs and a Black Monday collapse of the stock market, the Feds apparently reversed course (or maybe this was their intention all along?) and did just exactly what they said they would not do, and put into place a program to bail out depositors who were not covered by the FDIC’s limit of $250k per account.

The FDIC also closed another bank, Signature Bank in New York, but assured depositors that they could get all of their money out of their accounts on Monday.

And it worked, as futures trading that began Sunday night jumped up, instead of crashing, and Wall Street breathed a deep sigh of relief.

We now have had 3 FDIC-insured banks fail in 5 days, but it doesn’t matter if your account was insured or not, as the Fed is just going to give everyone their money back.